Mastering Forex Trading A Comprehensive Guide to Education and Strategies 1783939063

Mastering Forex Trading: A Comprehensive Guide to Education and Strategies

The Forex market, the largest and most liquid financial market in the world, attracts millions of traders annually. Many aspire to dive into Forex trading to earn substantial profits, but failing to educate oneself can lead to significant losses. This article will guide you through essential aspects of Forex trading education, helping you build a strong foundation for your trading career. For further insights and resources, visit forex trading education exglobal.pk.

Understanding the Basics of Forex Trading

Forex, or foreign exchange, involves trading one currency for another. It operates 24 hours a day, five days a week, and is known for its high volatility and liquidity. Familiarizing yourself with the basic terminology and concepts is crucial. Key terms include:

- Pip: The smallest price move that a given exchange rate can make based on market convention.

- Lot: A unit of measurement for trading volumes, which can be standard (100,000 units), mini (10,000), or micro (1,000).

- Spread: The difference between the bid and ask price of a currency pair.

- Leverage: A practice that allows traders to control a larger position than their initial investment.

Why Education is Important in Forex Trading

Many beginners in Forex trading underestimate the importance of education. Without proper knowledge, traders can make impulsive decisions based on market emotions rather than informed strategies. Education helps in understanding market dynamics, which is essential for developing effective strategies and risk management practices. Moreover, educated traders are more likely to stick to their trading plans and avoid common pitfalls.

Types of Forex Trading Education

Forex education comes in various formats. Here are some common options:

1. Online Courses

Many platforms offer comprehensive Forex trading courses. These online modules allow traders to learn at their own pace and cover everything from technical analysis to fundamental indicators.

2. Webinars and Workshops

Interactive learning through webinars and workshops enables participants to engage with experts. These sessions often include real-time analysis and trading strategies, making them incredibly valuable.

3. Books and eBooks

A plethora of books by seasoned traders and Forex experts covers various trading aspects. Reading can enhance your understanding and provide different perspectives on trading approaches.

4. Simulation and Practice Accounts

Many brokers provide demo accounts where novice traders can practice without risking real money. This is a critical step in applying what you’ve learned and gaining practical experience.

Developing a Trading Strategy

A well-defined trading strategy is fundamental to successful Forex trading. It should consider your trading goals, risk tolerance, and market analysis approach. Key components of any strategy include:

- Market Analysis: This involves both technical and fundamental analysis. Technical analysis focuses on price movements while fundamental analysis considers economic indicators and news events.

- Risk Management: Determining risk tolerance is crucial. Implement techniques like stop-loss orders to minimize potential losses.

- Trading Plan: Outline the rules and criteria for entering and exiting trades. A clear plan helps maintain discipline and reduce emotional trading.

Essential Forex Trading Strategies

Successful traders often implement various strategies, tailored to their specific goals. Here are some popular strategies to consider:

1. Day Trading

Day trading involves buying and selling currencies within a single trading day. Day traders aim to capitalize on short-term market movements and typically close positions before the market closes.

2. Swing Trading

Swing trading captures price swings over a period of days or weeks. Traders employ technical analysis to identify potential reversal zones and capitalize on market momentum.

3. Position Trading

Position trading takes a long-term view, where traders hold positions for weeks, months, or even years. This strategy relies heavily on fundamental analysis and broader market trends.

Psychology of Trading

The psychological aspect of trading often determines success or failure. Emotions can heavily influence trading decisions, leading to costly mistakes. To manage trading psychology effectively:

- Stay Disciplined: Stick to your trading plan and avoid impulsive decisions based on fear or greed.

- Accept Losses: Losses are part of trading. Accepting them as learning opportunities can help improve your strategy.

- Set Realistic Goals: Aim for achievable targets rather than setting yourself up for failure with unrealistic expectations.

Finding the Right Broker

Choosing a suitable Forex broker is crucial for your trading success. Consider the following factors when selecting a broker:

- Regulation: Ensure the broker is regulated by a reputable authority to guarantee safety.

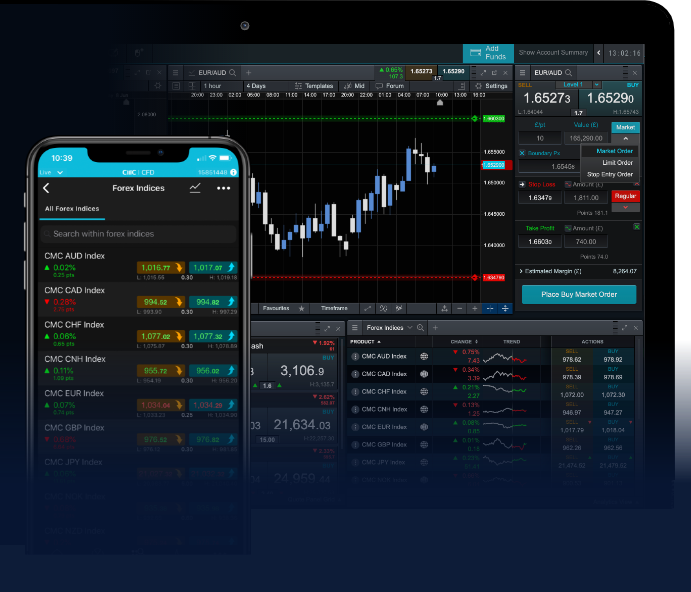

- Trading Platform: The trading platform should be user-friendly and equipped with essential tools for analysis.

- Fees and Spreads: Analyze the fee structure and the spreads offered, as these can impact overall profitability.

- Customer Support: Responsive customer service is vital, especially for new traders who may have questions or require assistance.

Conclusion

Forex trading offers substantial opportunities, but it requires dedication and education. By understanding the fundamentals, developing a precise trading strategy, and continuously improving your knowledge, you can enhance your chances of success in the Forex market. Remember, every successful trader was once a beginner. Take the time to learn, practice, and develop your skills. The journey may be challenging, but with persistence and the right education, you can achieve your financial goals.